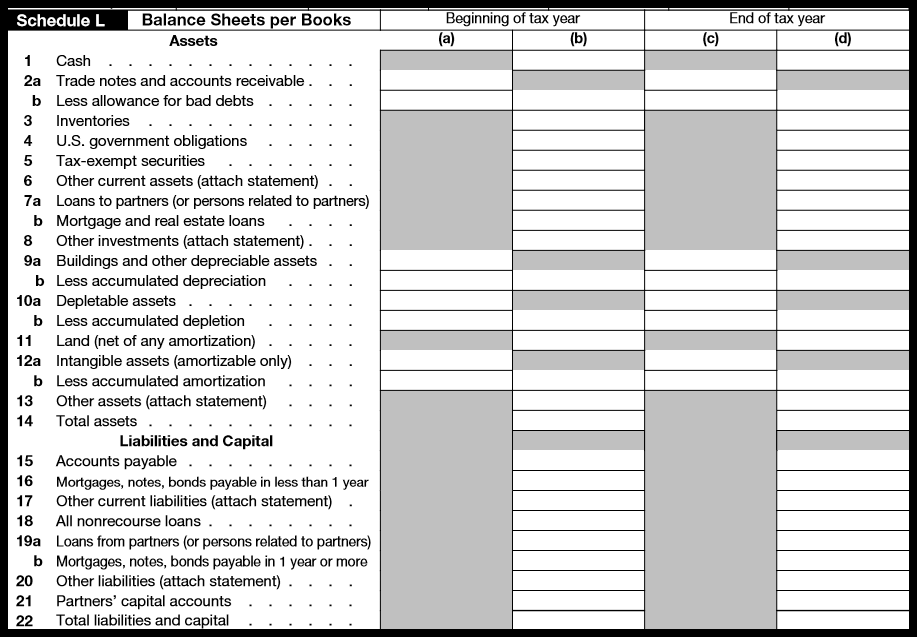

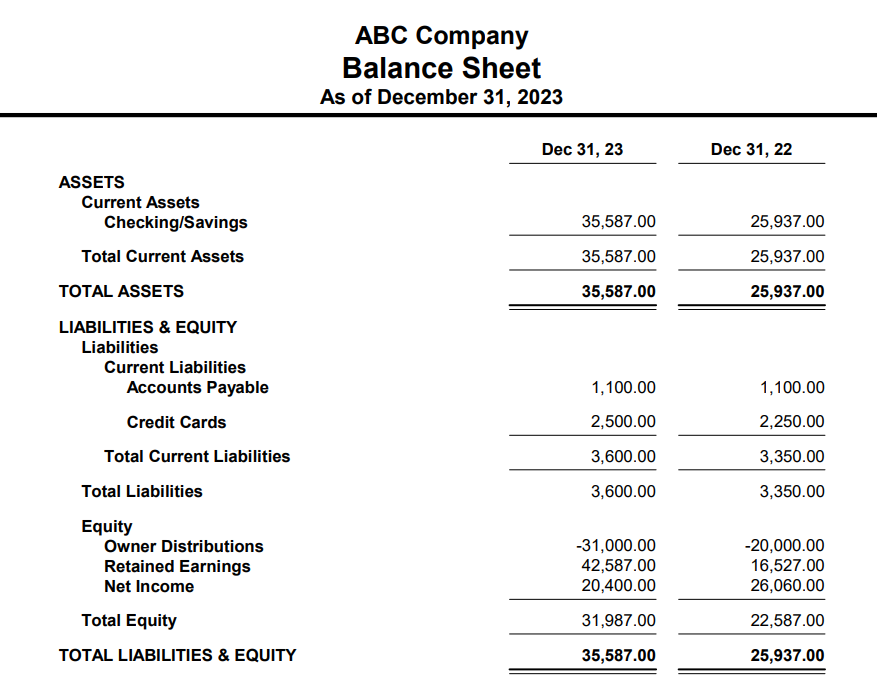

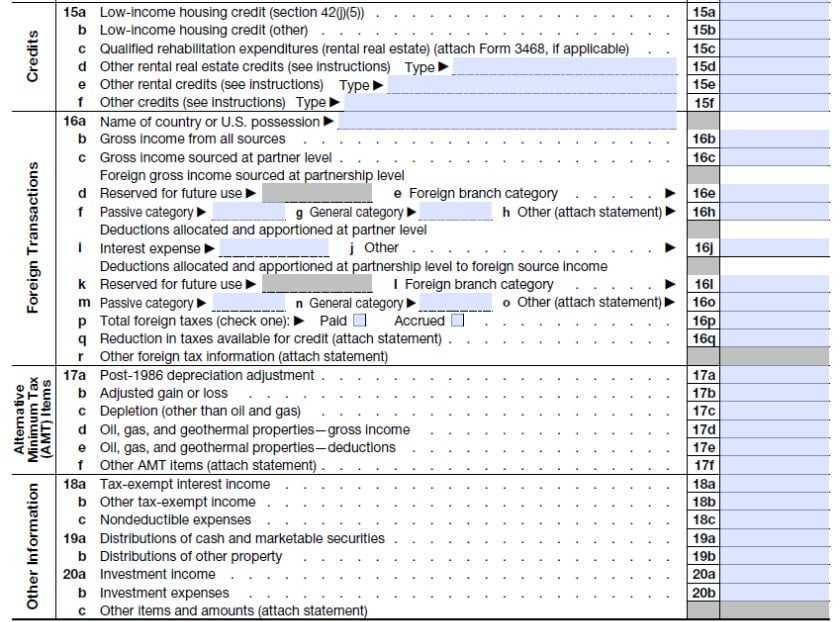

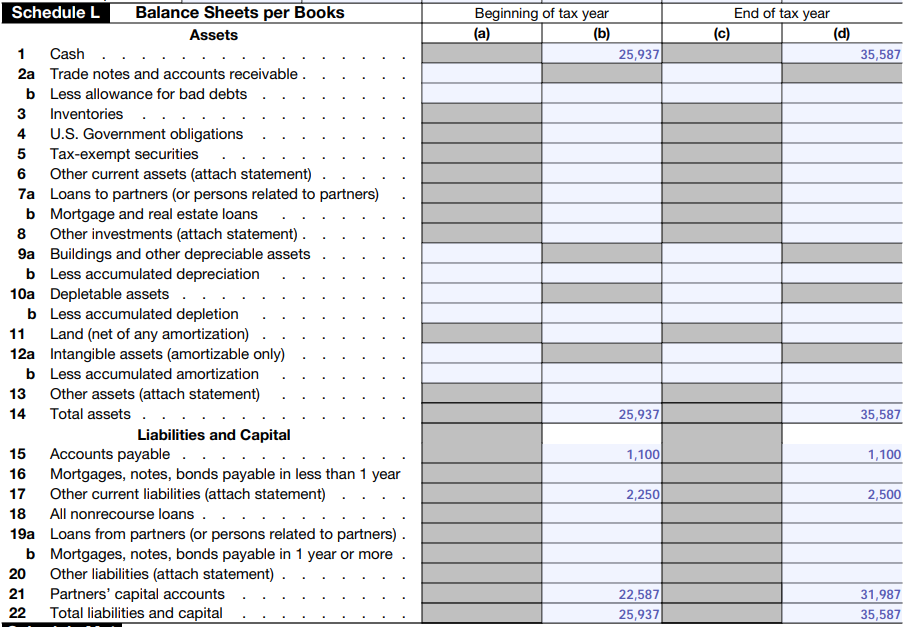

1065 Balance Sheet Requirements - Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. A partnership has to complete a schedule l (balance sheet); Yes, partnerships are required to include a balance sheet (using. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. When a return is made for a partnership by a receiver,.

Yes, partnerships are required to include a balance sheet (using. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership by a receiver,. A partnership has to complete a schedule l (balance sheet);

When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Yes, partnerships are required to include a balance sheet (using. A partnership has to complete a schedule l (balance sheet); Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the.

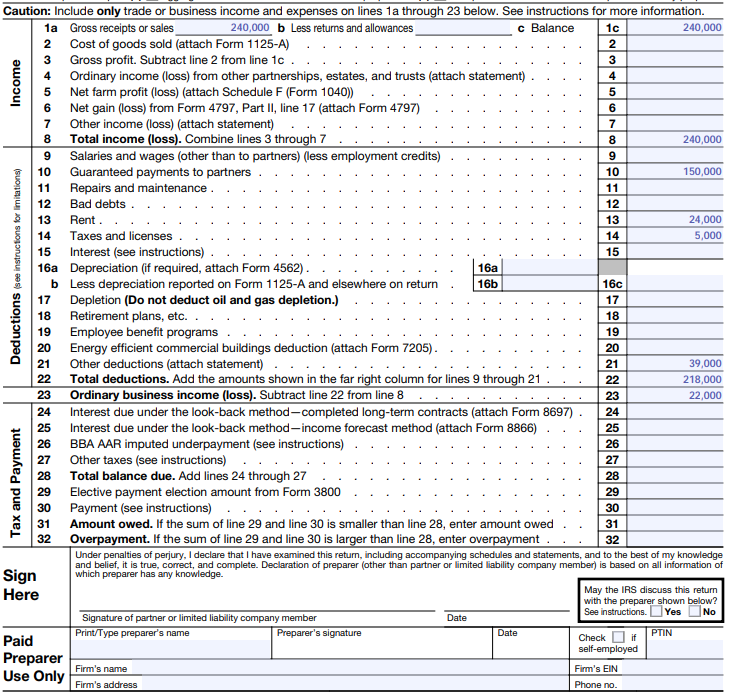

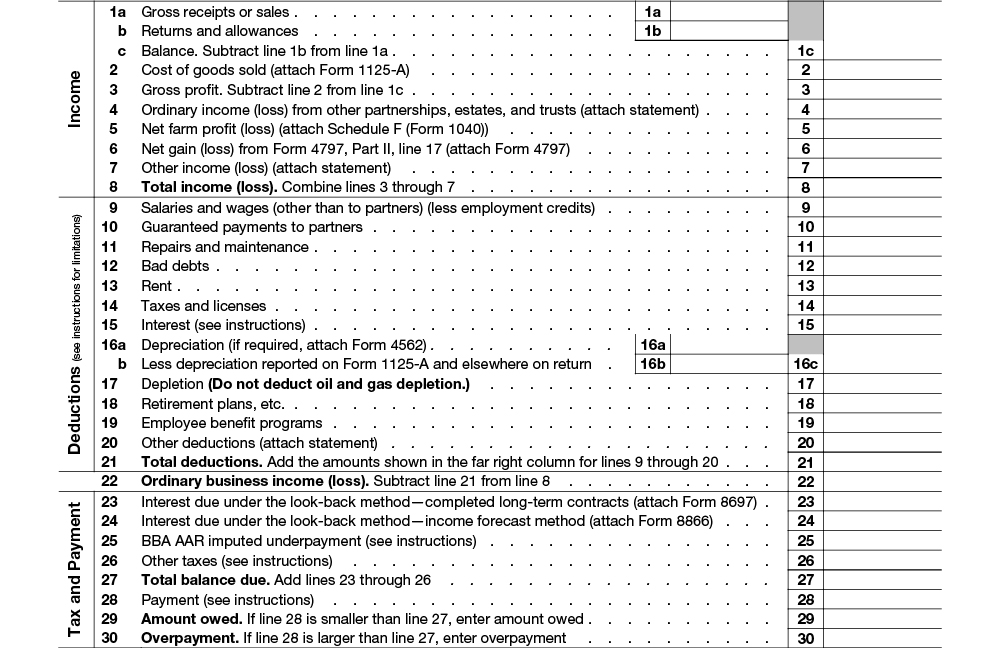

How To Complete Form 1065 US Return of Partnership

A partnership has to complete a schedule l (balance sheet); When a return is made for a partnership by a receiver,. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Do i need to include a balance sheet with form 1065? Form 1065 isn't considered to be a.

Form 1065 StepbyStep Instructions (+Free Checklist)

Yes, partnerships are required to include a balance sheet (using. Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Schedule l is required when the partnership does not meet the four requirements outlined in schedule.

Form 1065 StepbyStep Instructions (+ Free Checklist)

Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not.

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

A partnership has to complete a schedule l (balance sheet); When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Do i need to include a balance sheet with form 1065? Yes, partnerships are required to.

Form 1065BU.S. Return of for Electing Large Partnerships

A partnership has to complete a schedule l (balance sheet); Yes, partnerships are required to include a balance sheet (using. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member..

IRS Form 1065 Schedules L, M1, and M2 (2022) Balance Sheets (L

When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not.

Form 1065 StepbyStep Instructions (+Free Checklist)

Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Yes, partnerships are required to include a balance sheet (using. A partnership has to complete a schedule l (balance sheet); When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b,.

Form 1065 StepbyStep Instructions (+Free Checklist)

Do i need to include a balance sheet with form 1065? A partnership has to complete a schedule l (balance sheet); Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When a return is made for a partnership by a receiver,. Schedule l is required when the partnership does not meet the.

How to fill out an LLC 1065 IRS Tax form

Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership by a receiver,. Yes, partnerships are required to include a balance sheet (using. When the requirements for form 1065, schedule.

Form 1065 Instructions U.S. Return of Partnership

A partnership has to complete a schedule l (balance sheet); Yes, partnerships are required to include a balance sheet (using. Do i need to include a balance sheet with form 1065? Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet the four.

When A Return Is Made For A Partnership By A Receiver,.

Do i need to include a balance sheet with form 1065? Yes, partnerships are required to include a balance sheet (using. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the.

A Partnership Has To Complete A Schedule L (Balance Sheet);

Form 1065 isn't considered to be a return unless it's signed by a partner or llc member.