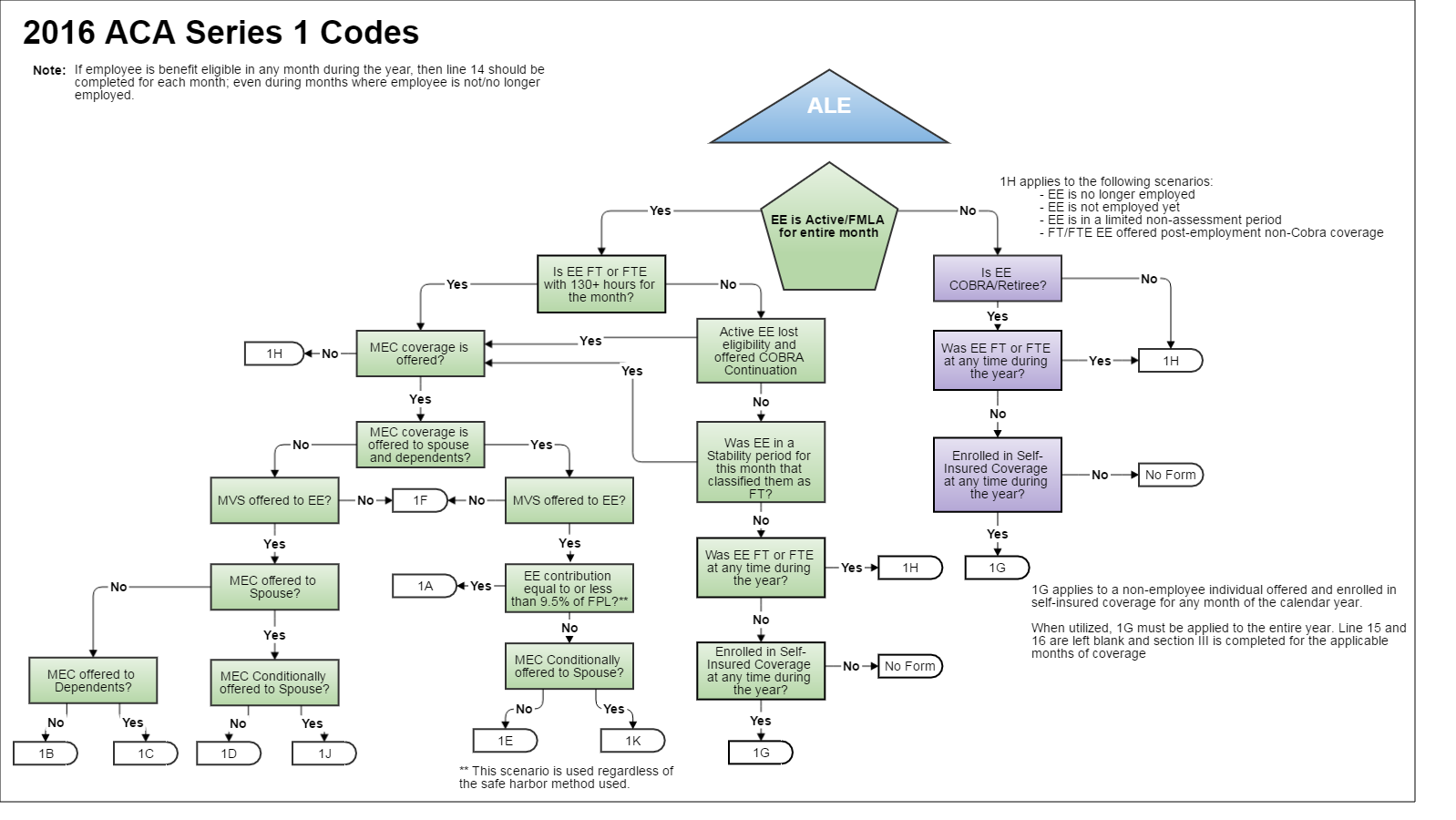

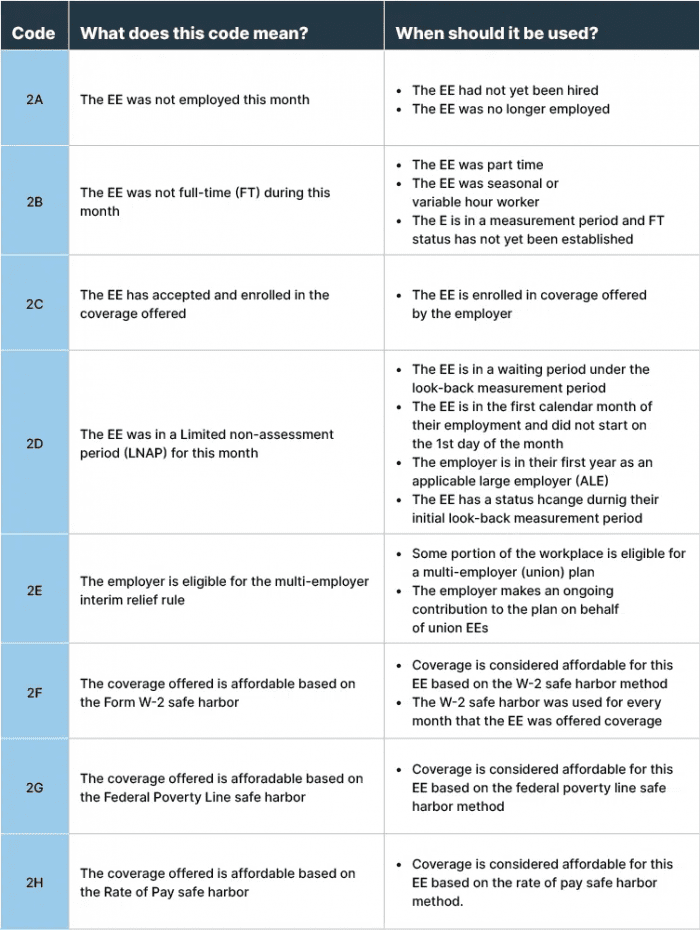

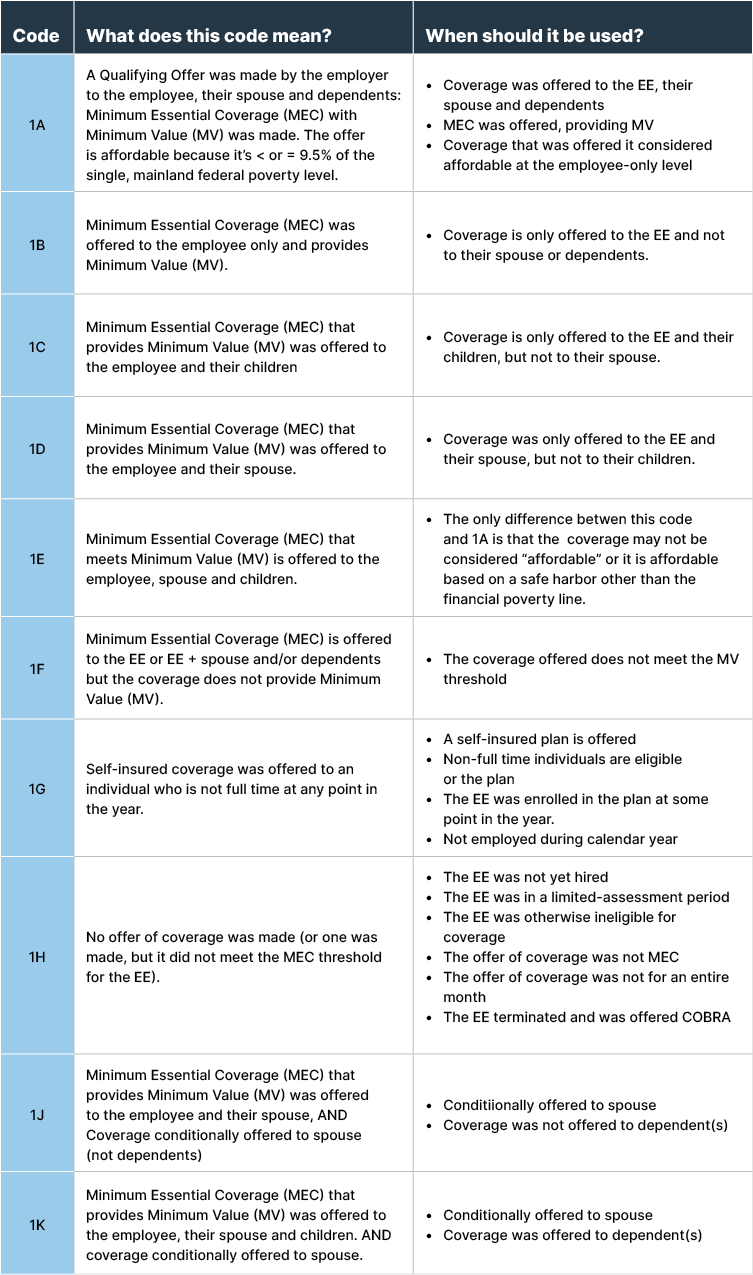

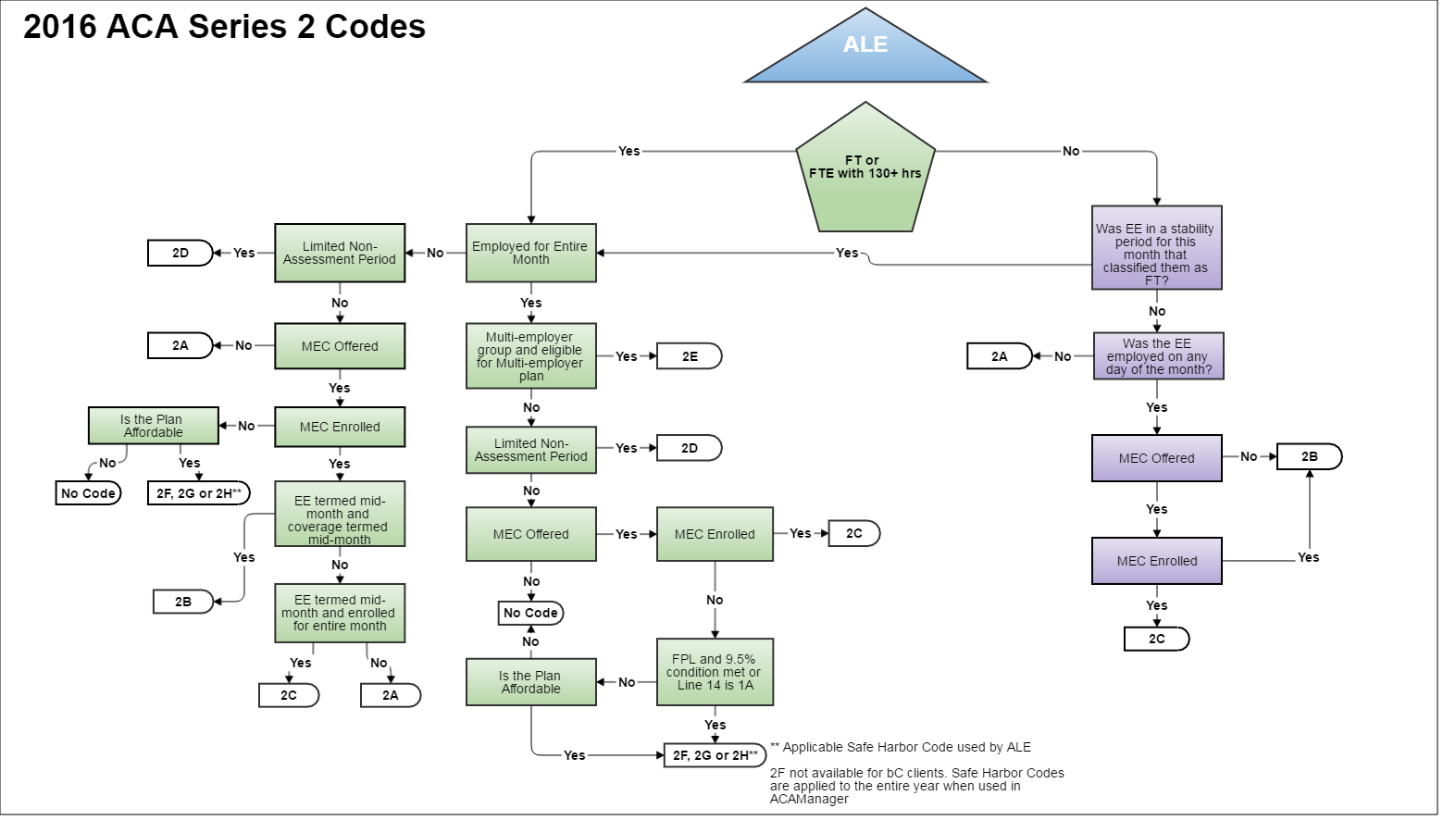

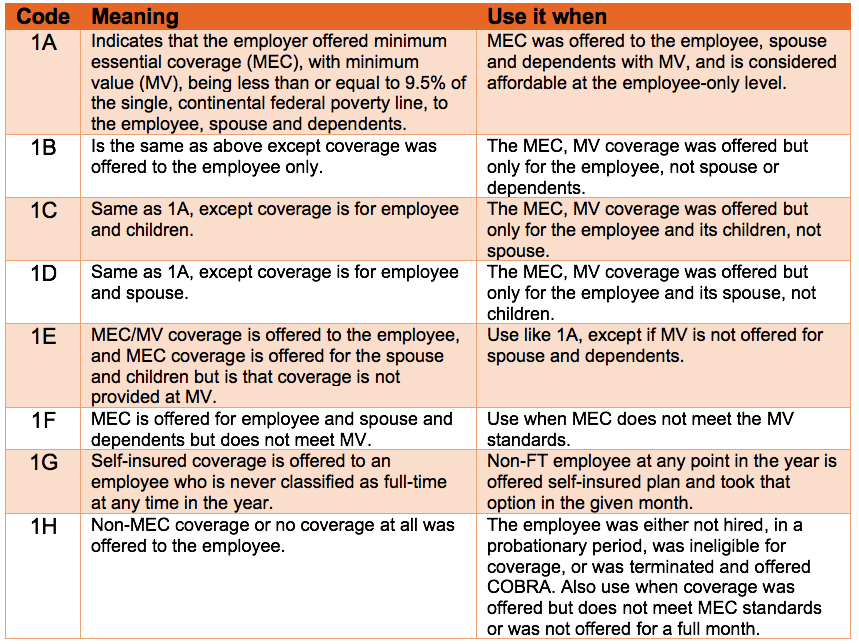

Aca Cheat Sheet - Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. It is used to report the employee’s enrollment only. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing. This section uses two sets of codes released by the irs to help employers have.

This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing.

This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. It is used to report the employee’s enrollment only. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing. Lowest hourly rate this year was $10/hour.

ACA Code Cheatsheet

$10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. Lowest hourly rate this year was $10/hour. It is used to report the employee’s enrollment only. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee.

ACA Codes a 1095Cheat Sheet You're Gonna love

Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. It is used to report the employee’s enrollment only. This section uses two sets of codes released by the irs to help employers.

The Affordable Care Act (ACA) Code Cheat Sheet You Need Advantage

Lowest hourly rate this year was $10/hour. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. It is used to report the employee’s enrollment only. As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers.

The Affordable Care Act ACA Code Cheat Sheet You Need Aca Staff Health Form

This section uses two sets of codes released by the irs to help employers have. Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. We created this cheat sheet to help you address employee questions and understand your filing. It is used to report the employee’s enrollment only.

ACA Code Cheatsheet

$10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. We created this cheat sheet to help you address employee questions and understand your filing. Lowest hourly.

Affordable Care Act (ACA) Reporting Cheat Sheet Reporting Made Easy

This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. We created this cheat sheet to help you address employee questions and understand your filing. It is used to report the employee’s enrollment only. $10/hour x 130 hours per month (aca full time) x.

Affordable Care Act (ACA) Reporting Cheat Sheet Reporting Made Easy

It is used to report the employee’s enrollment only. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. Lowest hourly rate this year was.

ACA Code Cheatsheet

As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have. Lowest hourly rate this year was $10/hour. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. It is used to report the employee’s enrollment.

ACA Codes A 1095 Cheat Sheet You're Gonna Love! Thread HCM

It is used to report the employee’s enrollment only. This section uses two sets of codes released by the irs to help employers have. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. As part of the aca, the irs created two sets of. We created this cheat sheet to.

ACA Code Cheatsheet

As part of the aca, the irs created two sets of. We created this cheat sheet to help you address employee questions and understand your filing. This section uses two sets of codes released by the irs to help employers have. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130..

This Section Uses Two Sets Of Codes Released By The Irs To Help Employers Have.

$10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. It is used to report the employee’s enrollment only. Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of.