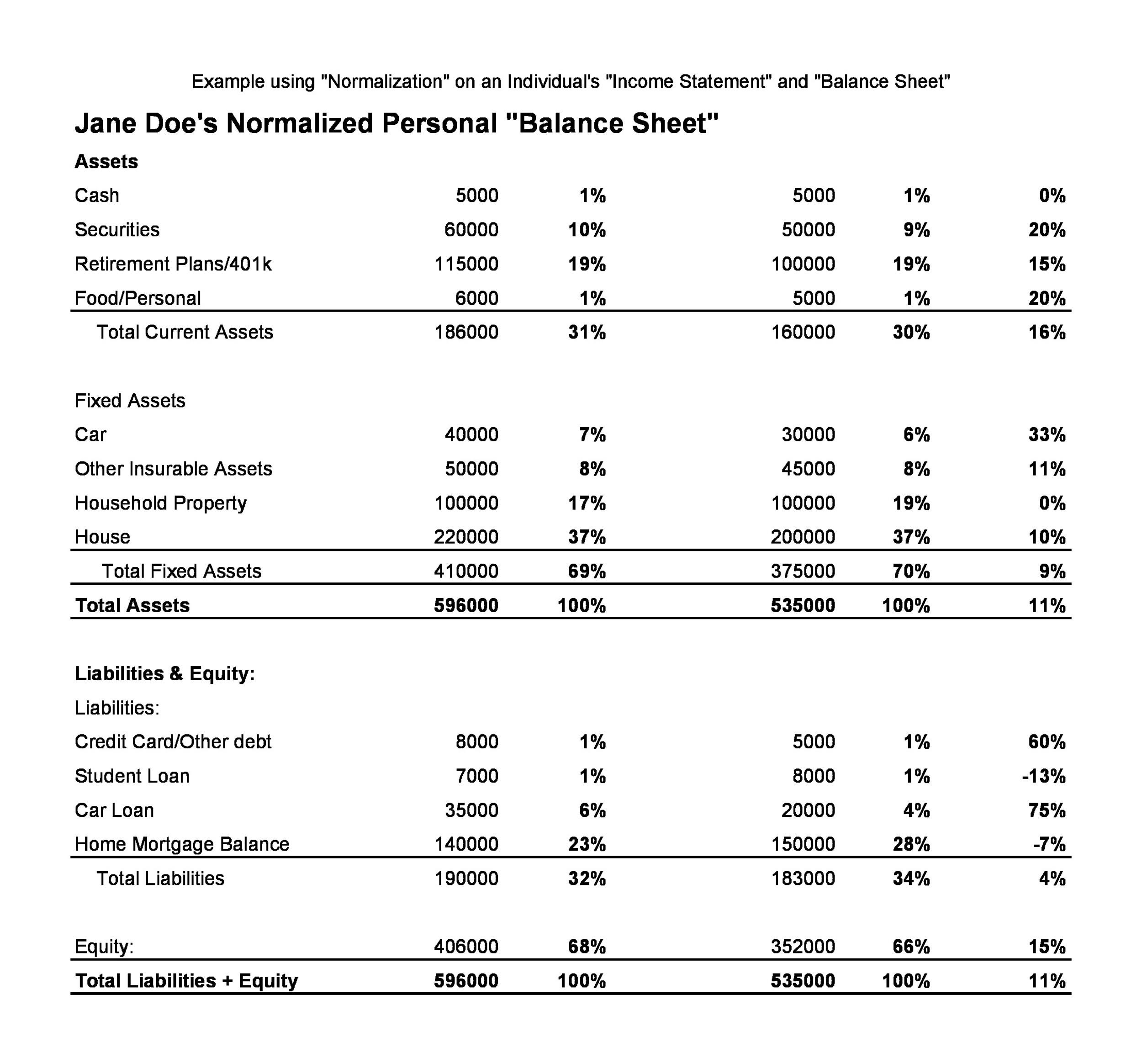

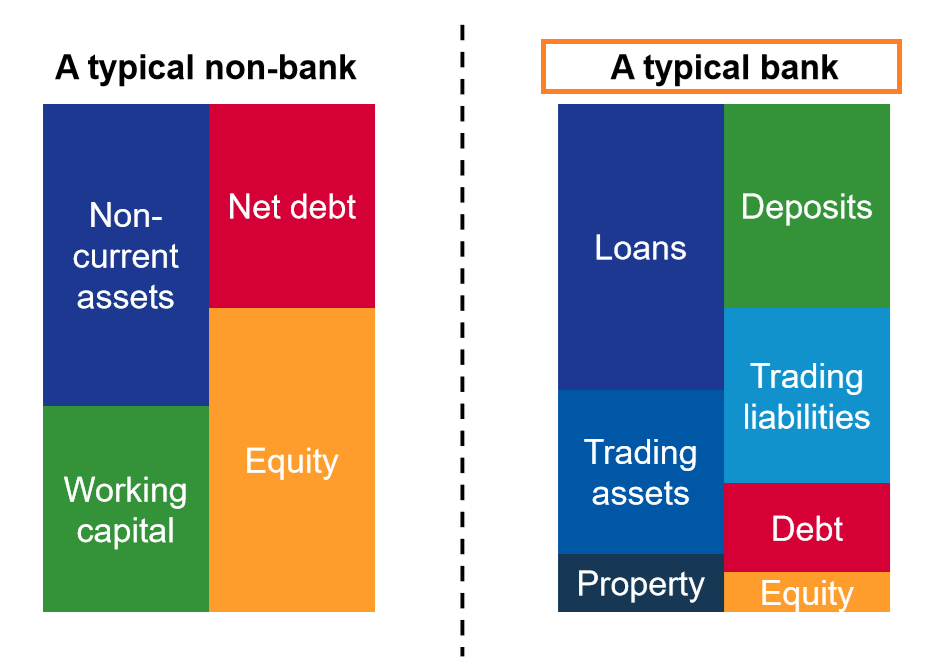

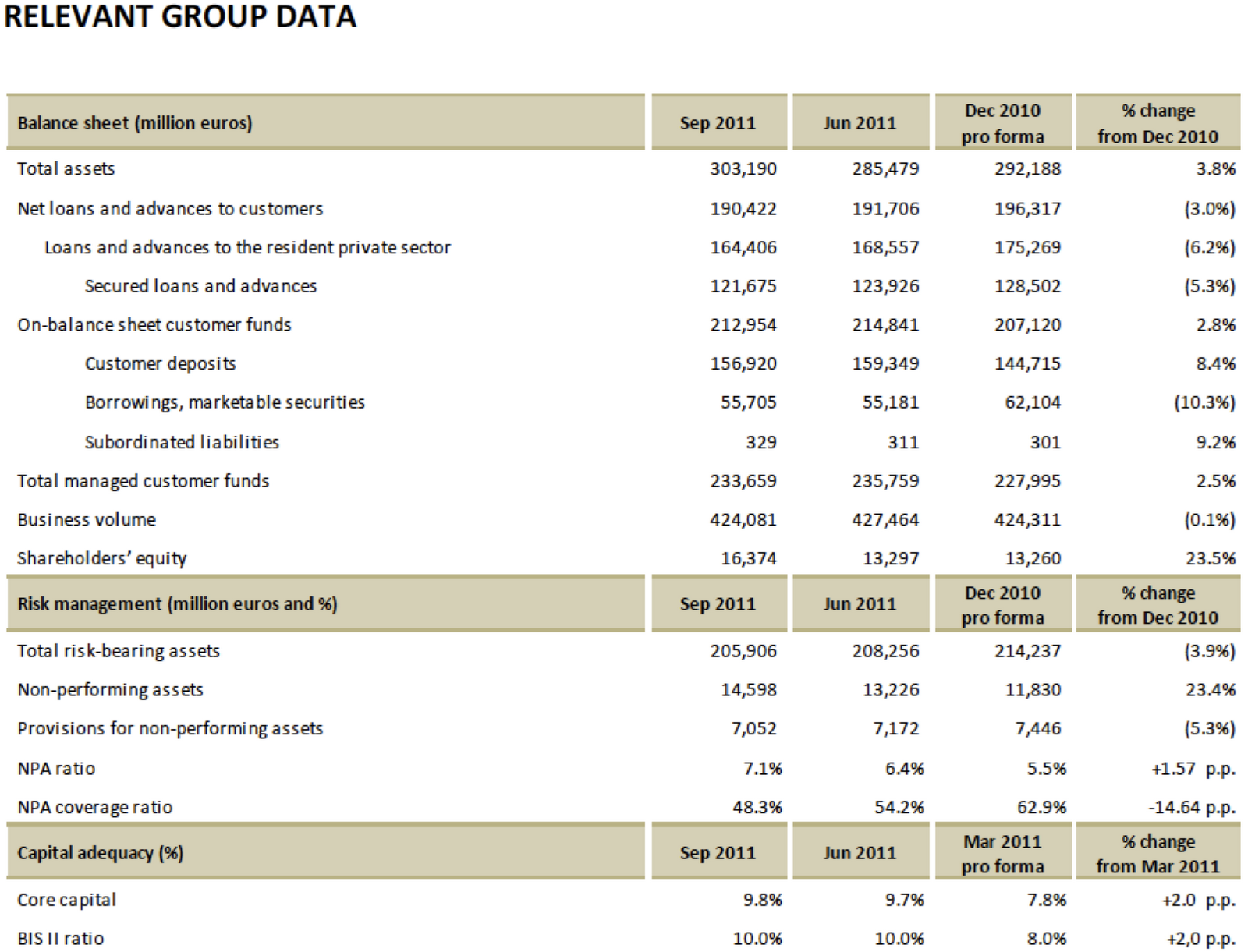

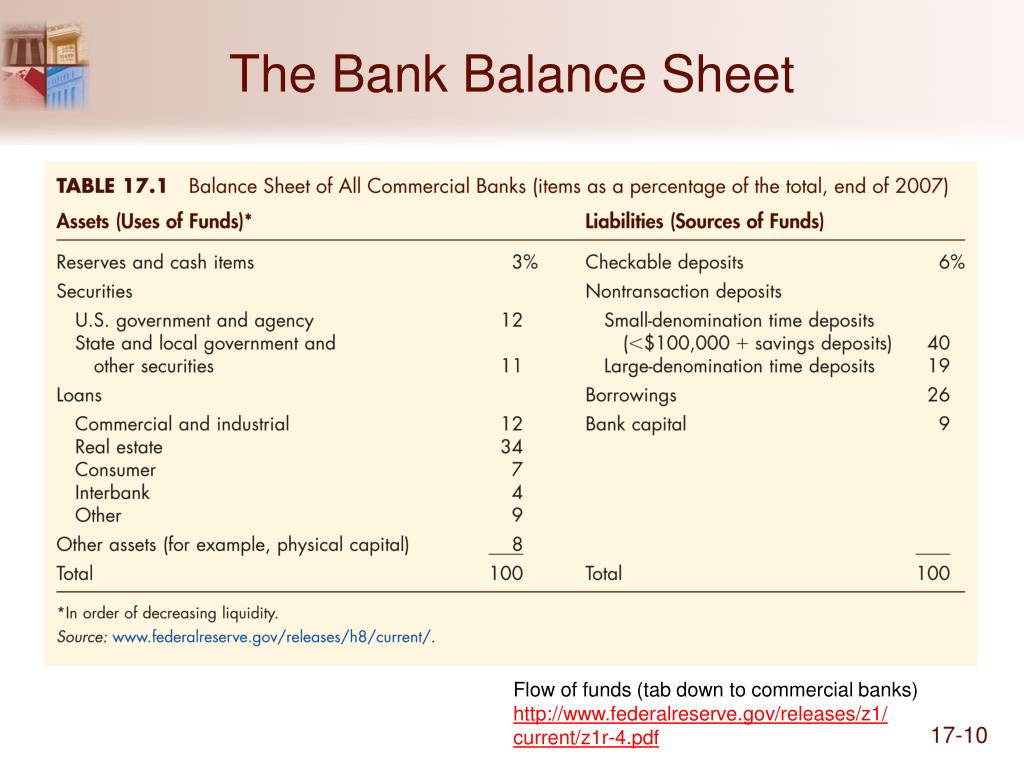

Bank Balance Sheet - It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. Below you will find a. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. A bank's balance sheet provides a snapshot of its financial position at a specific time.

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. Below you will find a. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. A bank's balance sheet provides a snapshot of its financial position at a specific time. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its.

Below you will find a. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

Financial Statements for Banks

It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning.

First Republic Bank Balance Sheet 2024 Adah Linnie

Below you will find a. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. Bank balance sheets are an accounting of a bank’s liabilities.

What are assets and liabilities of Central Bank Economics Class 12

A bank's balance sheet provides a snapshot of its financial position at a specific time. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its..

bank balance sheet explanation YouTube

It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. A bank's balance sheet provides a snapshot of its financial position at a specific time..

PPT Chapter 17 PowerPoint Presentation ID74190

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. A bank's balance sheet provides a snapshot of its financial position at a specific time. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well.

[Economics] What is Understanding Balance sheet of a Commercial Bank

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. A bank's balance sheet.

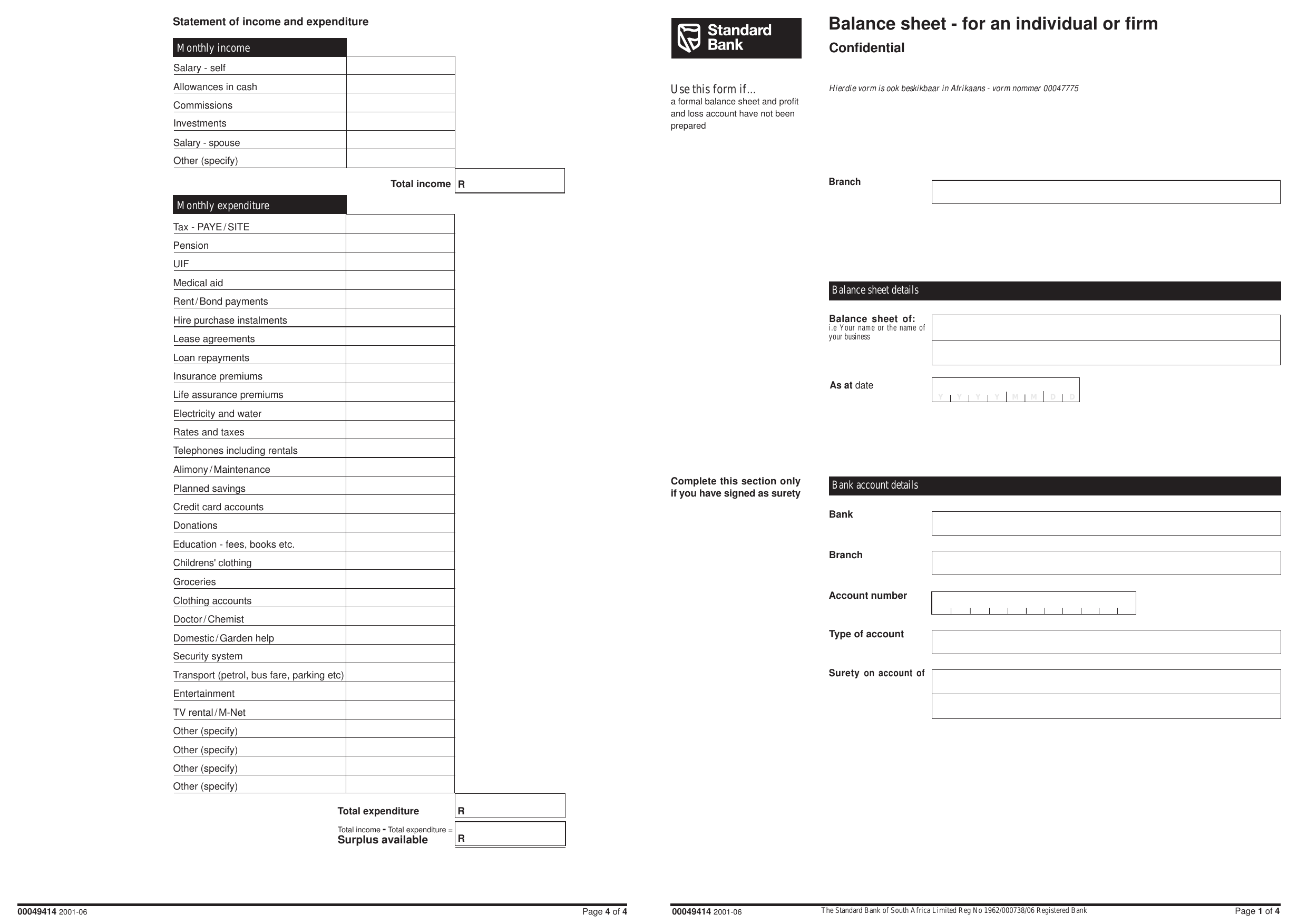

Download Bank Balance Sheet Template Excel PDF RTF Word

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. It consists of assets,.

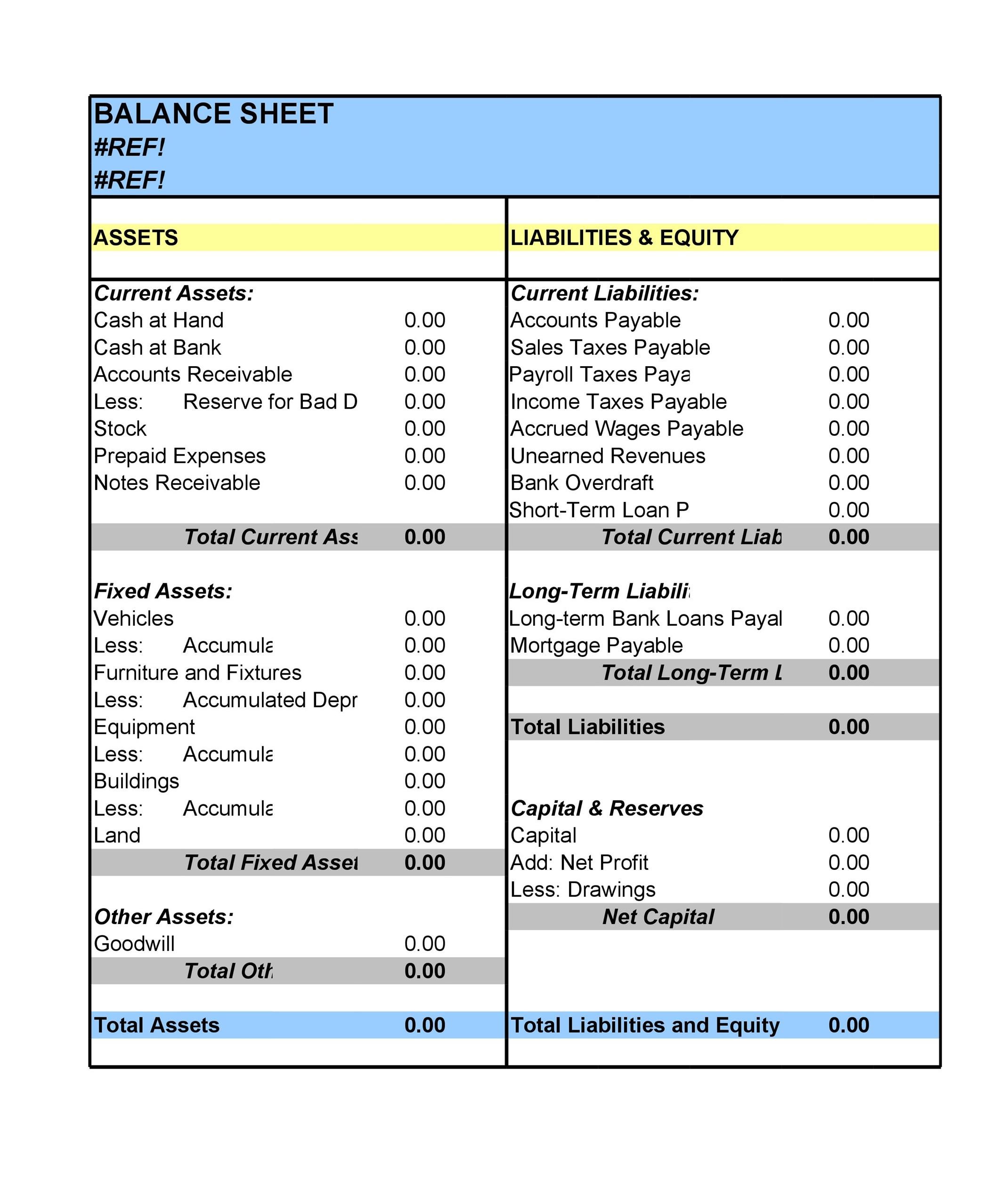

38 Free Balance Sheet Templates & Examples Template Lab

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. The table below combines a bank of america balance.

[Economics] What is Understanding Balance sheet of a Commercial Bank

Below you will find a. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics..

Balance Sheet

The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. A bank's balance sheet.

Banks Use Much More Leverage Than Other Businesses And Earn A Spread Between The Interest Income They Generate On Their Assets (Loans) And Their Cost Of Funds (Customer.

The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. Below you will find a. A bank's balance sheet provides a snapshot of its financial position at a specific time.

It Consists Of Assets, Representing What The Bank Owns, And Liabilities, Describing What It Owes To Its.

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d1avenlh0i1xmr.cloudfront.net/775196c2-41d1-4e4b-8375-e87ae25ac777/different-assets-and-liabilities-of-a-commercial-bank---teachoo.jpg)

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)