Buildings On Balance Sheet - Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. This page provides guidance on when costs for buildings and improvements must be capitalized at the university. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Fill in your balance sheet. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. On the “buildings” line in the “property, plant & equipment” section, write the original cost of.

Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. This page provides guidance on when costs for buildings and improvements must be capitalized at the university. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. Fill in your balance sheet. On the “buildings” line in the “property, plant & equipment” section, write the original cost of.

When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. This page provides guidance on when costs for buildings and improvements must be capitalized at the university. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. Fill in your balance sheet.

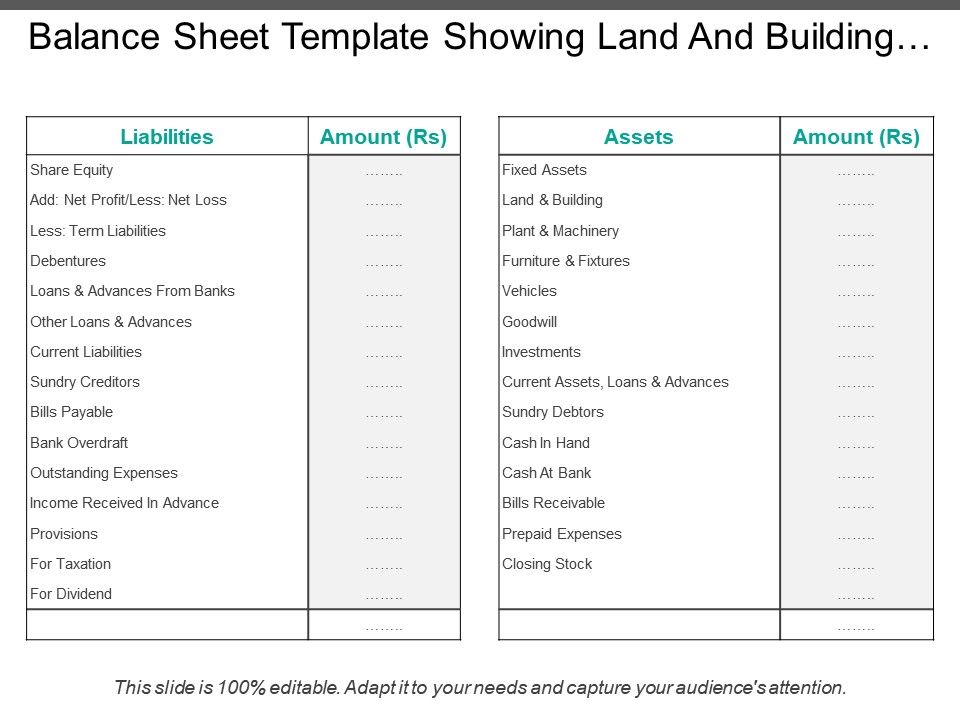

Balance Sheet Template Showing Land And Building Loans Advances

This page provides guidance on when costs for buildings and improvements must be capitalized at the university. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. When you acquire a building, you record it on.

How to Review an Unbalanced Balance Sheet ⋆ Accounting Services

Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Fill in your balance sheet. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to.

AnalyzingaCondoorCoopBuildingsBalanceSheet Hauseit Balance

When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. This page provides guidance on when costs for buildings and improvements must be capitalized at the university. Learn.

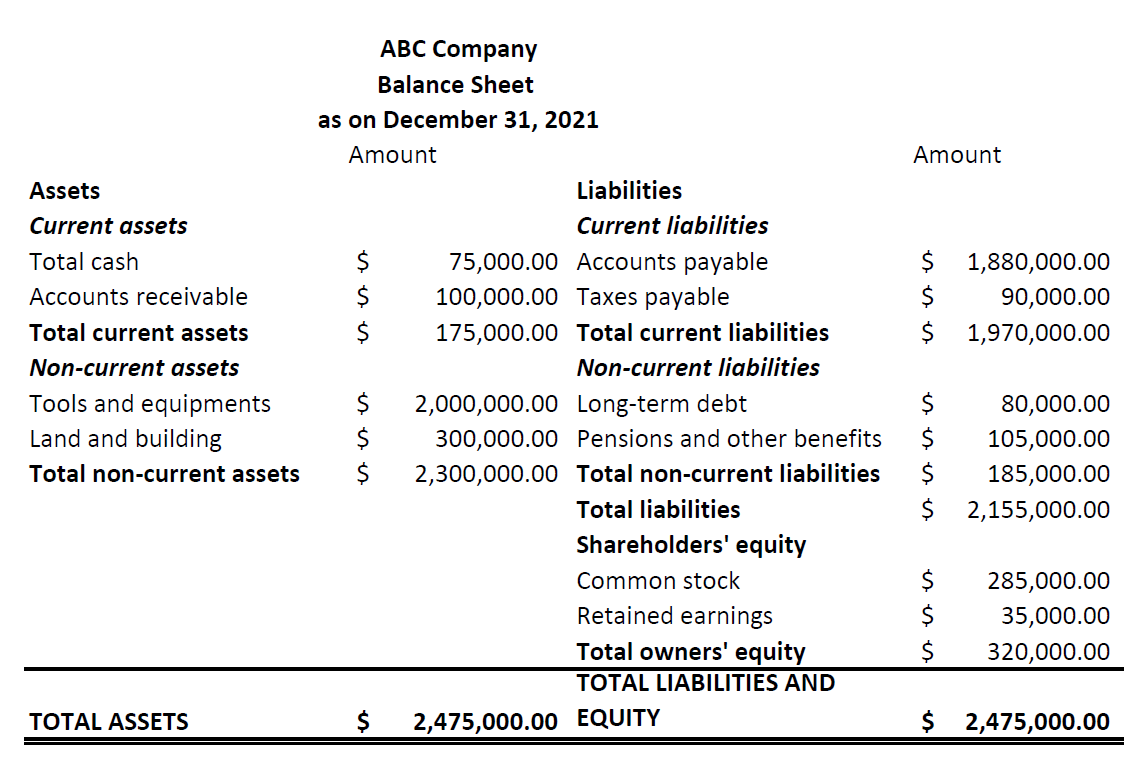

How To Prepare a Balance Sheet A StepbyStep Guide Capterra

Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. This page provides guidance on when costs for buildings and.

Is my Building an Asset or Liability?

Fill in your balance sheet. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. This page provides guidance on.

Balance Sheet Format for Construction Company in Excel

Fill in your balance sheet. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000.

The Balance Sheet A Howto Guide for Businesses

Fill in your balance sheet. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. This page provides guidance on when costs for buildings and improvements must be capitalized at the university. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. When you acquire a building, you record it.

Building a balance sheet Building Dashboards with Microsoft Dynamics

On the “buildings” line in the “property, plant & equipment” section, write the original cost of. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. Fill in your balance sheet. Company abc owns a building that cost $ 500,000 and accumulated depreciation of.

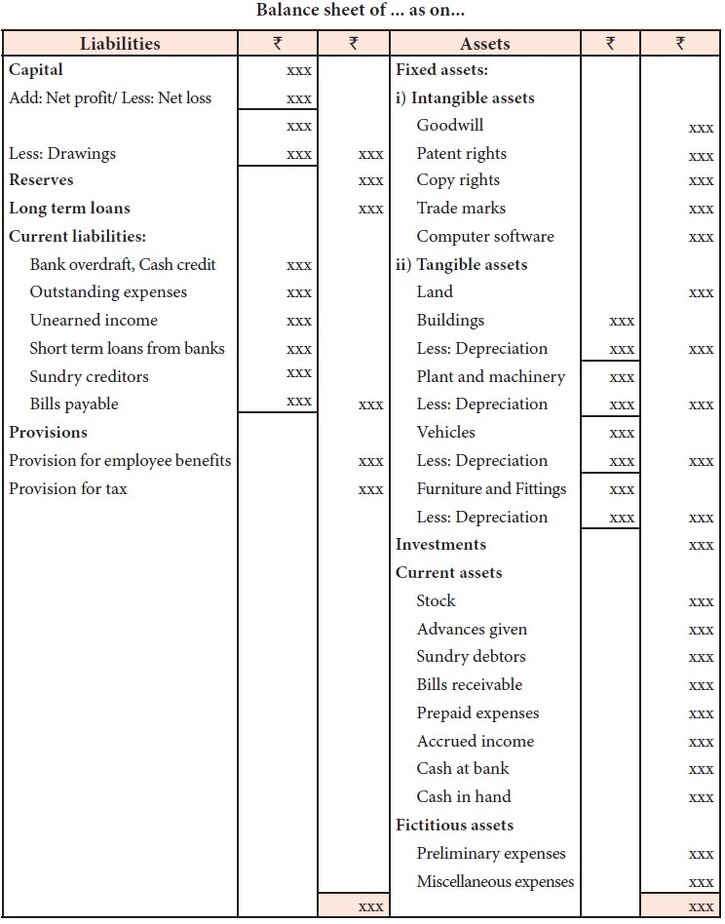

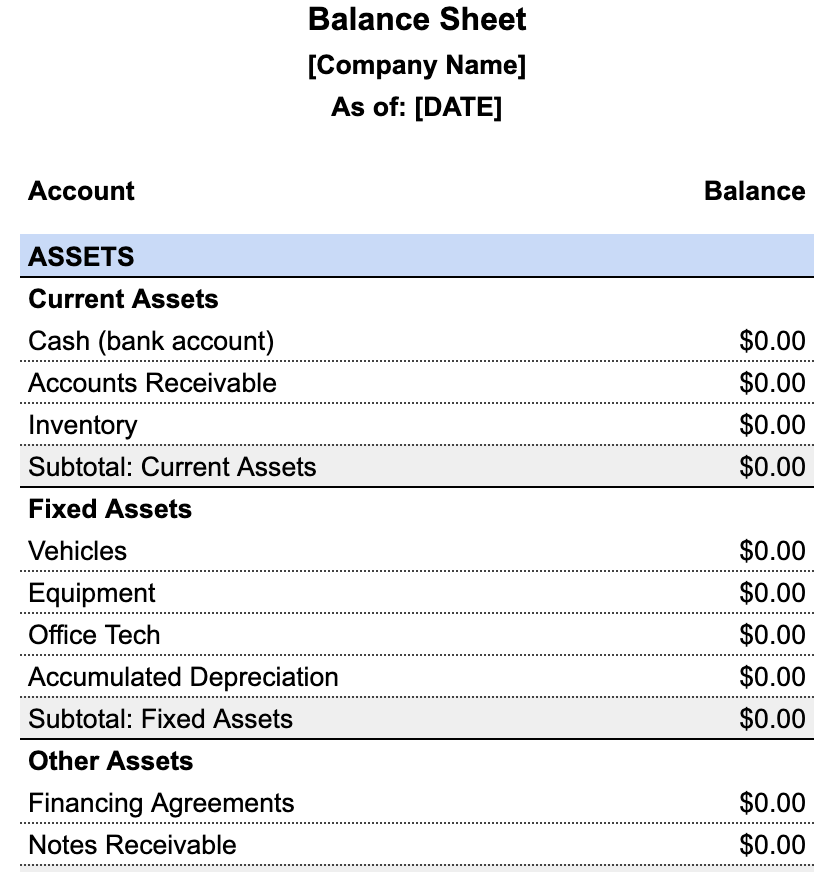

a template for a balance sheet [1]. Download Scientific Diagram

Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Fill in your balance sheet. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to.

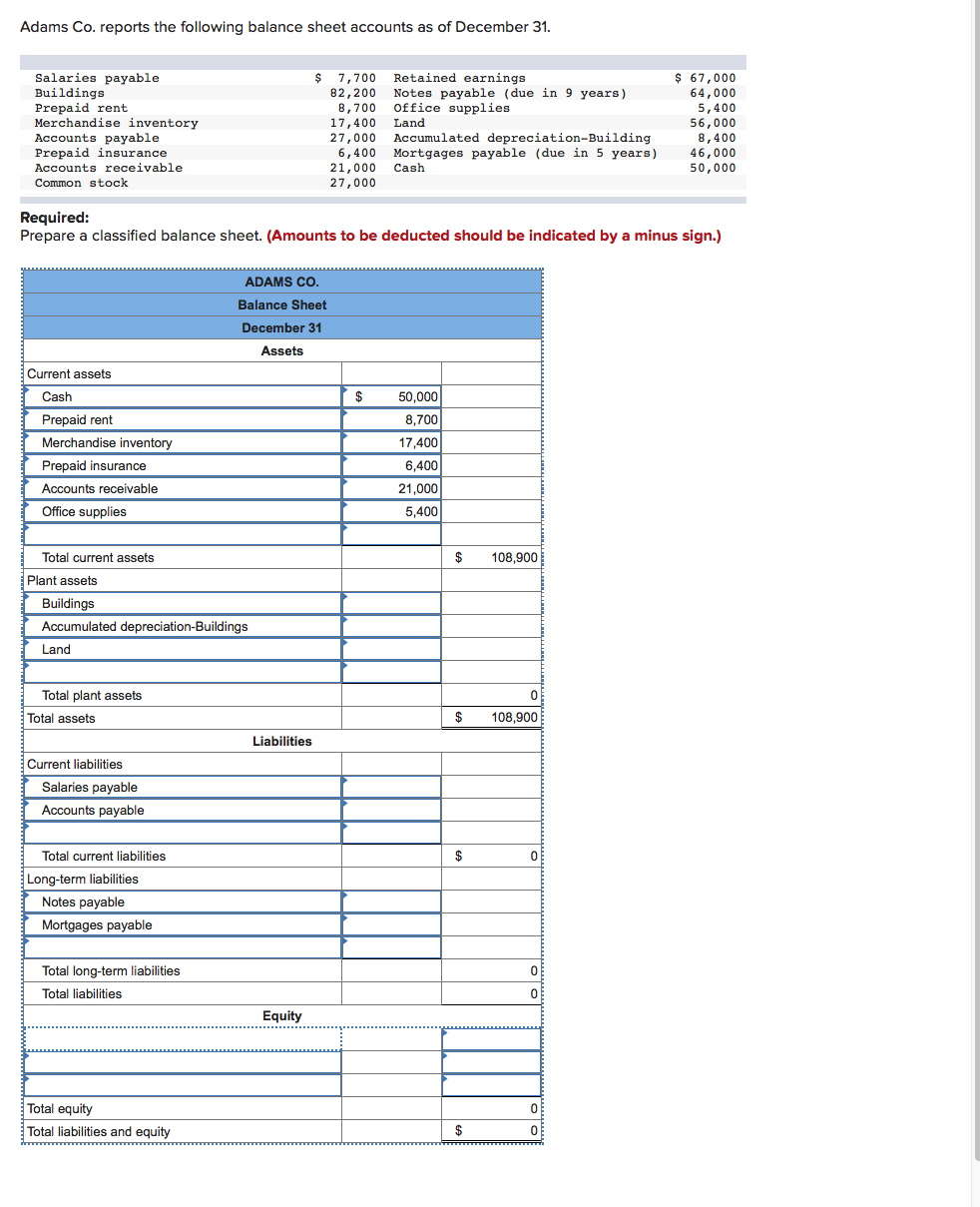

Solved Adams Co. reports the following balance sheet

Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. This page provides guidance.

When You Acquire A Building, You Record It On Your Balance Sheet At Its Purchase Price Plus Any Costs Related To The Acquisition And Preparation For.

Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Fill in your balance sheet. On the “buildings” line in the “property, plant & equipment” section, write the original cost of. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date.

![a template for a balance sheet [1]. Download Scientific Diagram](https://www.researchgate.net/publication/355043818/figure/fig1/AS:1076120615157764@1633578556495/a-template-for-a-balance-sheet-1.png)