Convert Rental Property To Primary Residence - On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations.

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. 1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. On january 1, 2011, she evicts her.

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000.

How To Convert Your Primary Residence To A Rental Property Rental

On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into.

How To Convert Your Primary Residence To A Rental Property Rental

On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. 1, 2022, the taxpayers convert the rental property into.

How To Convert A Primary Residence To A Rental Property Landlord Studio

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property had a $30,000. On january 1, 2011, she evicts her. 1, 2022, the taxpayers convert the rental property into.

How To Convert A Primary Residence To A Rental Property Landlord Studio

The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011,.

How to Convert a Primary Residence to a Rental Property

1, 2022, the taxpayers convert the rental property into their principal residence. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property.

How to Convert a Primary Residence to a Rental Property

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property.

How to Convert a Primary Residence to a Rental Property

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. On january 1, 2011,.

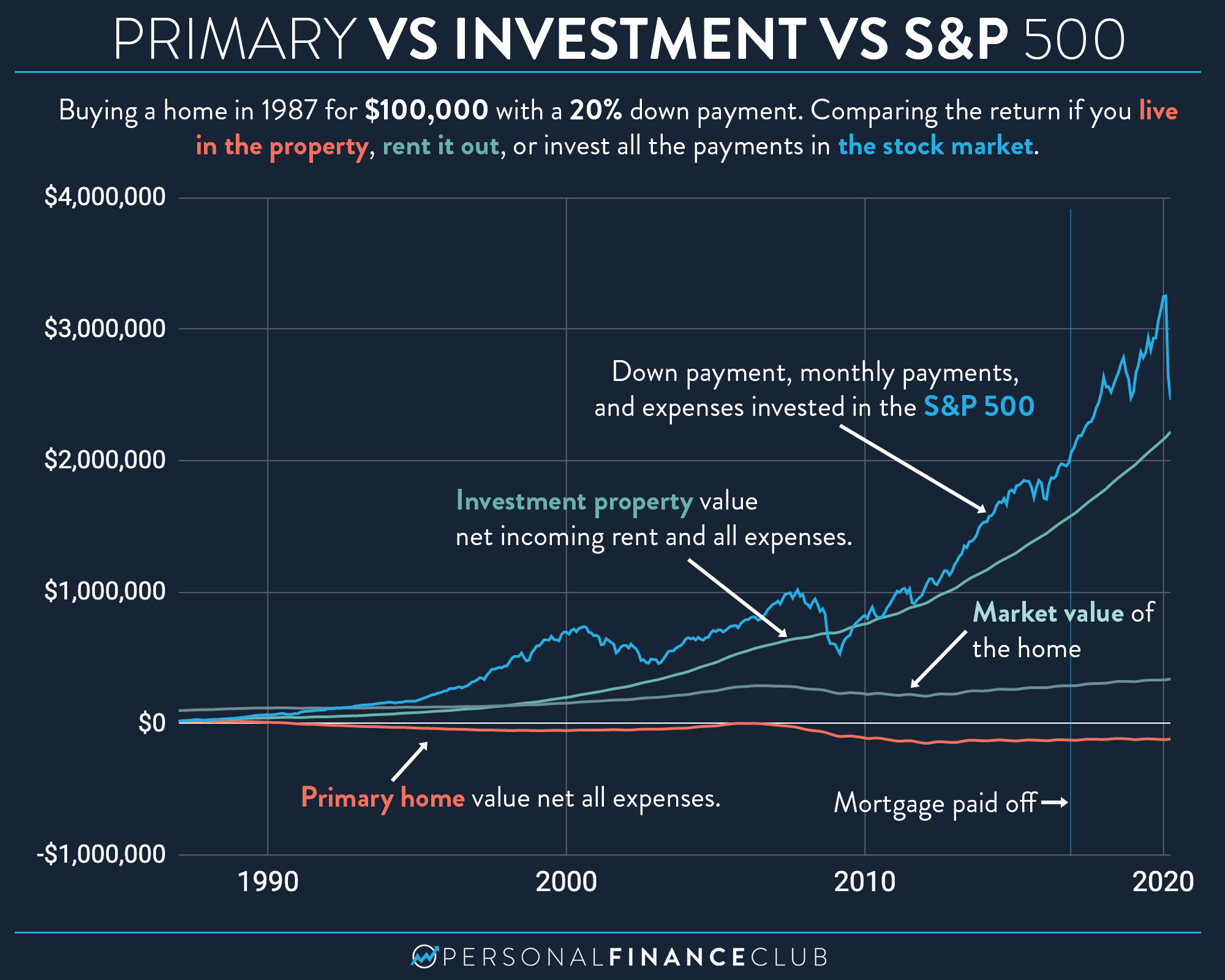

Primary home vs investment property vs S&P 500 Personal Finance Club

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into.

How to Convert a Property from Rental to Primary

The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into.

How to Convert Your Primary Residence to a Rental Property

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property had a $30,000. On january 1, 2011, she evicts her. 1, 2022, the taxpayers convert the rental property into their principal residence. Converting a rental or vacation home into your primary residence involves a mix of practical, legal,.

On January 1, 2011, She Evicts Her.

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years.