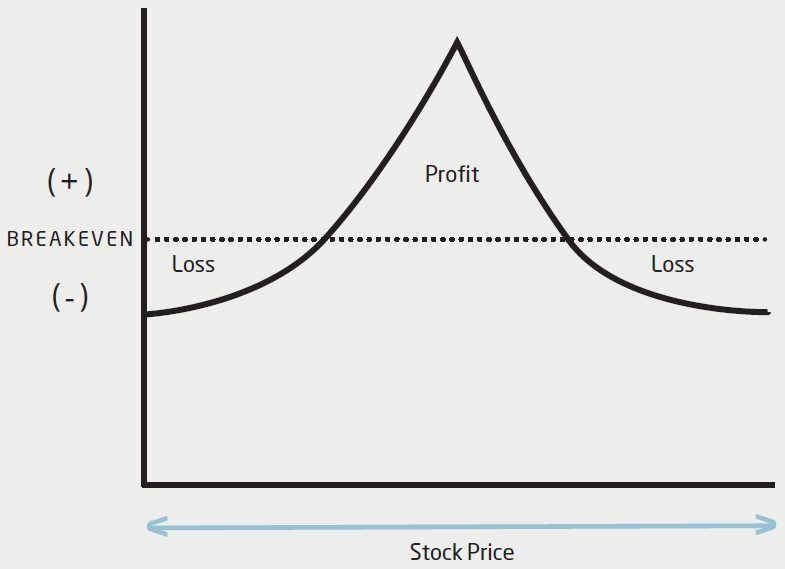

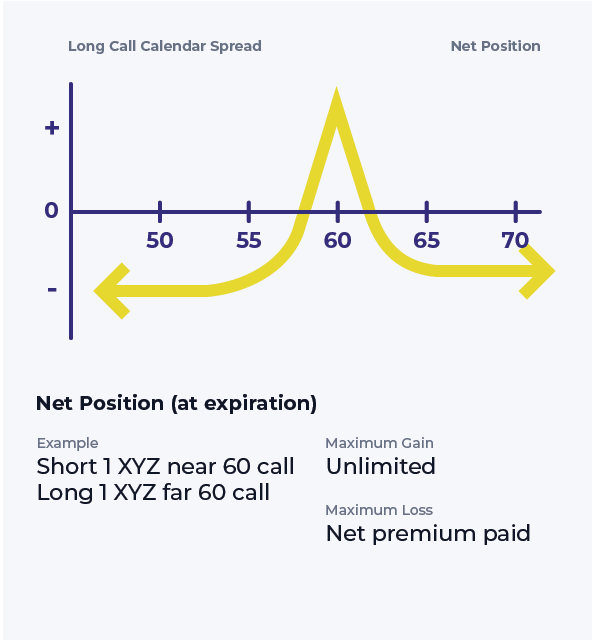

Long Call Calendar Spread - A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock.

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the.

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock.

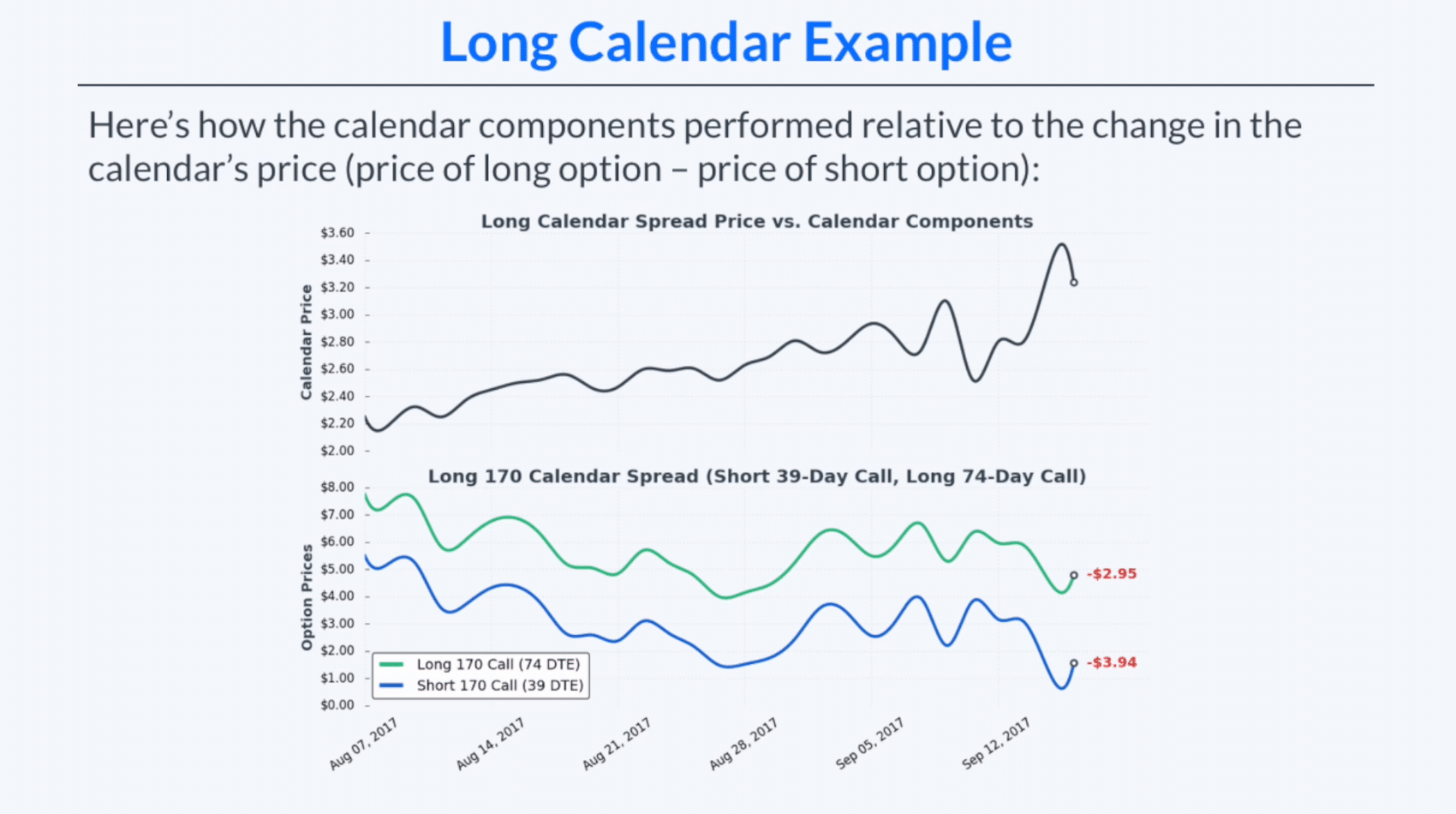

How to Trade Options Calendar Spreads (Visuals and Examples)

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to use a long call calendar spread to combine a bullish.

Calendar Call Spread Options Edge

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell.

Long Calendar Spreads for Beginner Options Traders projectfinance

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use a long call calendar spread to combine a.

Long Calendar Spreads Unofficed

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. This strategy involves buying a longer. Learn how to create and manage a long calendar spread.

The Long Calendar Spread Explained 1 Options Trading Software

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you.

Long Call Calendar Spread PDF Greeks (Finance) Option (Finance)

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you.

Long Calendar Spreads for Beginner Options Traders projectfinance

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell and buy same.

Long Calendar Spread with Calls Strategy With Example

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Learn how to create and manage a long calendar spread with.

Long Call Calendar Spread Options Strategy

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer. Learn how to create and manage a.

Long Calendar Spread with Calls

This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Learn how to create and manage a long calendar spread.

Learn How To Create And Manage A Long Calendar Spread With Calls, A Strategy That Profits From Neutral Or Directional Stock Price Action Near The.

This strategy involves buying a longer. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock.