Optum Hsa Tax Form - When completing your federal income taxes, you must obtain the following forms: Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Make the most of your health savings account (hsa) and understand all of the tax benefits. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. You need to file irs form 8889 with your income taxes to report contributions and distributions. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified.

Make the most of your health savings account (hsa) and understand all of the tax benefits. You need to file irs form 8889 with your income taxes to report contributions and distributions. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. When completing your federal income taxes, you must obtain the following forms:

You need to file irs form 8889 with your income taxes to report contributions and distributions. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. When completing your federal income taxes, you must obtain the following forms: Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified.

Fillable Online Tax Form Checklist for your HSA Optum Fax Email Print

Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. When completing your federal income taxes, you must.

Fillable Online optum hsa salary reduction form employee information

Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. When completing your federal income taxes, you must obtain the following forms: Learn how to save on taxes with an hsa, access your tax forms online,.

Fillable Online Health Savings Account (HSA) Account Closure Form

Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. You need to file irs form 8889 with your income taxes to report contributions and distributions. When completing your federal income taxes, you must obtain the.

How to file HSA tax Form 8889

Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. When completing your federal income taxes, you must.

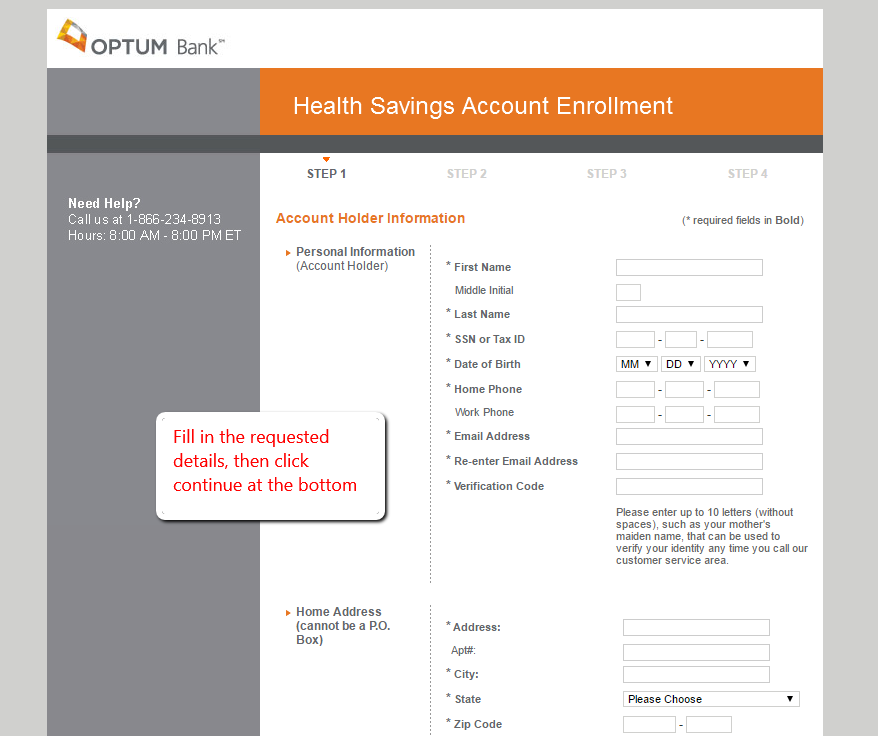

Optum Bank (HSA) Bank Online Banking

Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. When completing your federal income taxes, you must obtain the following forms: You need to file irs form 8889 with your income taxes to report contributions.

Using Your Health Payment Spending card HSAFSA Optum

When completing your federal income taxes, you must obtain the following forms: You need to file irs form 8889 with your income taxes to report contributions and distributions. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. Learn how to save on taxes with an hsa, access your tax forms online,.

Hsa Contribution Limits 2024 Tax Deduction Form Kare Marisa

You need to file irs form 8889 with your income taxes to report contributions and distributions. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Make the most of your health savings account (hsa) and.

Fillable Online OPTUM HSA SALARY REDUCTION FORM EMPLOYEE INFORMATION

Make the most of your health savings account (hsa) and understand all of the tax benefits. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. As the tax season approaches, you may be.

Using Your Health Payment Spending card HSAFSA Optum

Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. Make the most of your health savings account (hsa) and understand all of the tax benefits. As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. Learn how to save on taxes with an hsa, access.

Fillable Online Optum Financial HSA Designation of Beneficiary Form Fax

When completing your federal income taxes, you must obtain the following forms: As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified. Make the most of your health savings account (hsa) and understand all of the.

When Completing Your Federal Income Taxes, You Must Obtain The Following Forms:

As the tax season approaches, you may be asking yourself what you, as an hsa accountholder,. You need to file irs form 8889 with your income taxes to report contributions and distributions. Learn how to save on taxes with an hsa, access your tax forms online, and understand the rules. Learn how to save on taxes with an hsa, get copies of your tax forms, and report qualified.